Quick Summary:

- The main difference between traditional finance and cryptocurrency is that crypto is decentralized, unlike fiat.

- Cryptocurrency gives people control of their assets and offers financial freedom.

Traditional finance is also called centralized finance as our money is held by banks or companies. These banks are run by governments and or companies whose core purpose is to make money out of your deposits. Additionally, they charge fees for using their services. When you buy bread from a merchant using your credit card, the request first goes to the acquiring bank which forwards the card details to the card network, and then the payment is approved. Each entity involved in making that transaction successful charges you a fee. Also, the involvement of intermediaries slows the process of even a simple transaction. Where a bank might spend days approving a loan, cryptocurrencies offer it in a few seconds and clicks through the major DeFi platforms.

Difference between Traditional Finance and Cryptocurrency

The classic financial system limits the way you should be using your money however, with the advent of blockchain-based Cryptocurrencies, people have more financial freedom in their hands. Banks and governments control the value of fiat and the devaluation hurts normal people. But with cryptocurrencies, the value of the coins and tokens purely depends on the demand and supply. Through pair-to-pair transactions, it is super efficient to use cryptocurrencies.

USD stablecoins are killing other fiats in crypto trading.

— Tascha (@TaschaLabs) April 26, 2022

1% increase in USD stables txn growth leads to 0.5% drop in local-fiat-vs-crypto txn growth in 10 mo time (top right).

Meanwhile growth in local-fiat-vs-crypto txn leads to 1:1 growth in USD stable txns (bottom left). pic.twitter.com/VEIO3Qp715

Cryptocurrencies are taking over traditional fiat currencies. Crypto preachers predict crypto to be the main payment option in the next decade.

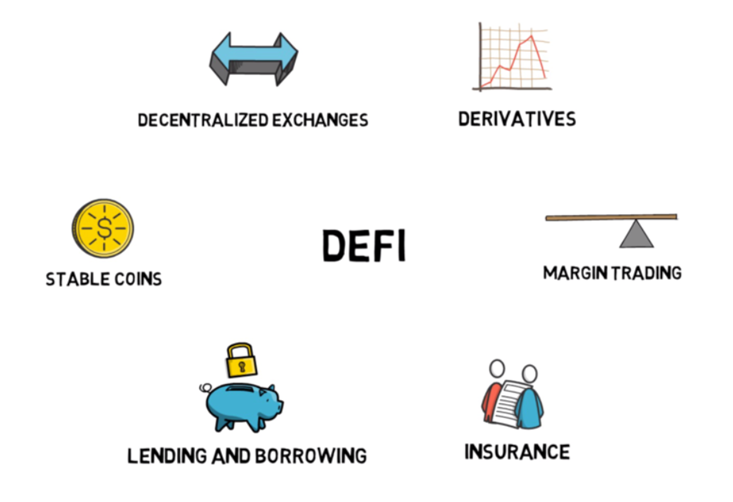

Cryptocurrencies have coined a new term DeFi or Decentralized Finance through which people can lend and borrow cryptocurrencies without any limits. The pair-to-pair DeFi does not mean you won’t have to pay the fees but it means that you’ll have exposure to more options since the lenders can be anywhere in the world as Cryptocurrencies don’t really mind the borders. The currency of the DeFi is crypto which is used to lend or borrow against specified collateral.

Conclusion:

DeFi and Cryptocurrencies offer so much freedom against monopolist banks and companies. Their ecosystem and decentralized nature are being challenged by the existing financial regulations. It’s a popular belief that DeFi is the biggest thing in the history of Finance.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.