Blockchain has revolutionized the transfer of value and allowed anyone not only to participate without permission but also to innovate without permission. The result has been a wild flourishing of different forms of tokenized value, and the birth of an industry — decentralized finance, or “DeFi”. Let us have a quick overview of what is Defi.

Why is DeFi better than traditional finance? Why don’t you just get your interest from a bank? Defi does not just take existing centralized finance concepts and make them available to the masses — it allows for entirely new applications to be imagined and created. Consider this. You place money into a contract that is not owned by anybody, then an autonomous software bot takes that money and uses it to take out a massive loan, performs complicated arbitrage operations for profit, and repays the loan in a fraction of a second at no risk. It splits the profits not with bankers, but between you and other depositors. Sounds Futuristic? Well, the future is here although it’s just one of the many examples. Do not forget the watch the video version of the article.

What is DEFI – Decentralized finance?

Short for decentralized finance, DeFi is an umbrella term for a variety of applications and projects in the public blockchain space geared toward disrupting the traditional finance world. Inspired by blockchain technology, DeFi is referred to as financial applications built on blockchain technologies, typically using smart contracts. Smart contracts are automated enforceable agreements that do not need intermediaries to execute and can be accessed by anyone with an internet connection.

DeFi consists of applications and peer-to-peer protocols developed on decentralized blockchain networks that require no access rights for easy lending, borrowing, or trading of financial tools. Most DeFi applications today are built using the Ethereum network, but many alternative public networks are emerging that deliver superior speed, scalability, security, and lower costs. Today, most DeFi applications are built on Etherereum.

The Benefits of Defi

The benefit of DeFi is the open finance platform on top which all projects reside. Besides this general advandated these are the main benefits:

- Programmability – programmed into smart contracts

- Transparency – smart contracts are open source

- Permissionless – any user can access

- Noncustodial – you hold the private keys

- Lack of intermediaries – no middleman

The DEFI Elements

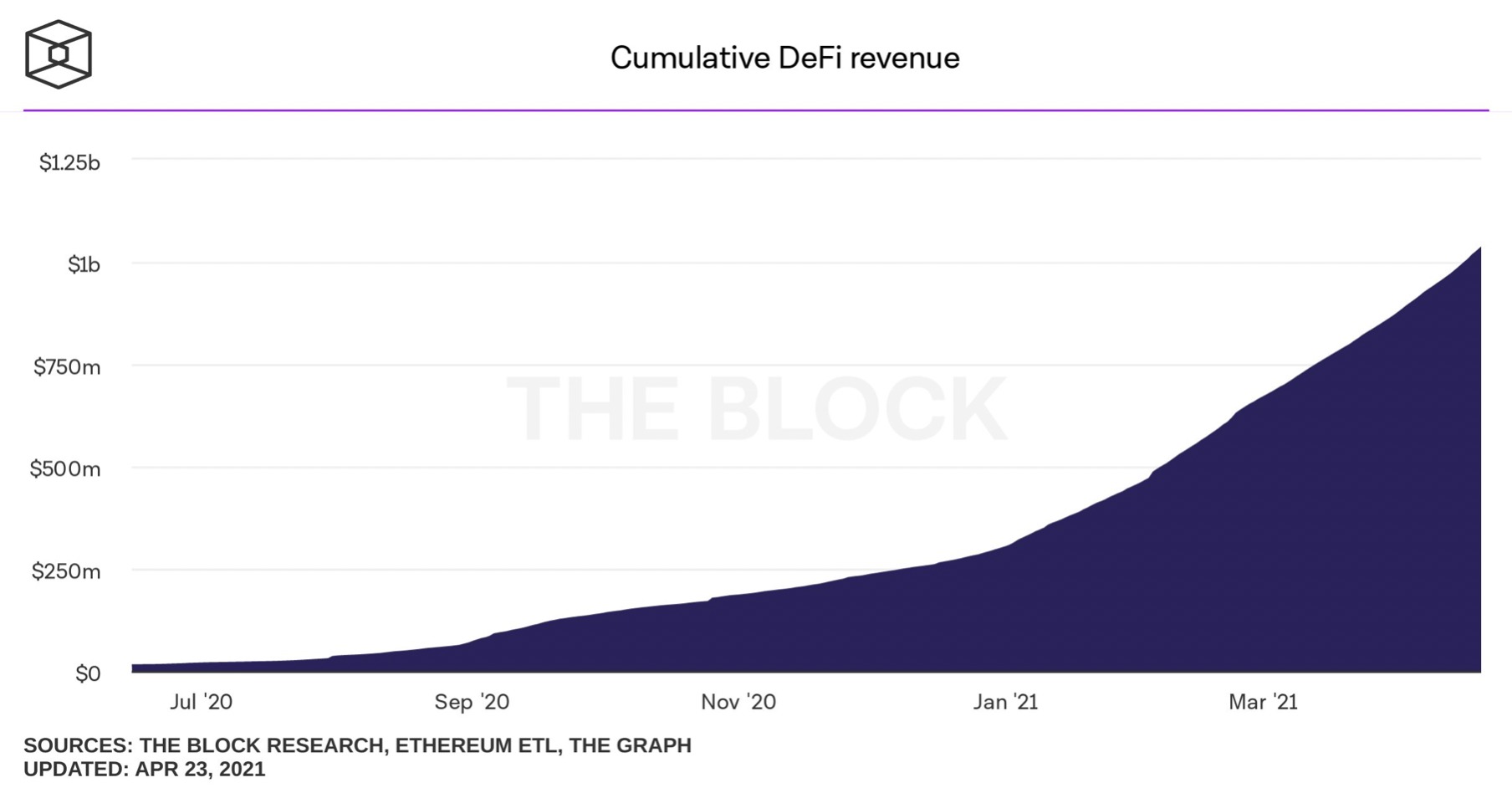

DeFi has grown into a complete ecosystem of working applications and protocols that deliver value to millions of users. Assets worth over $55 billion are currently locked in DeFi ecosystems, making it one of the fastest-growing segment within the public blockchain space.

Here’s an overview of the most popular DeFi use cases and protocols available in the market today:

Defi Lending and Borrowing

DeFi gave finance a new direction by enabling lending and borrowing. Widely regarded as ‘Open Finance’, decentralized lending offered crypto holders lending opportunities to gain annual yields. Decentralized borrowing allowed individuals to borrow money at a specific interest rate. The aim of lending and borrowing is to serve financial service use cases while fulfilling the needs of the cryptocurrency community. The actual defi rates can be found on this website. The most used lending – borrowing platforms are:

- Compound

- Maker

- Aave

Decentralized exchanges

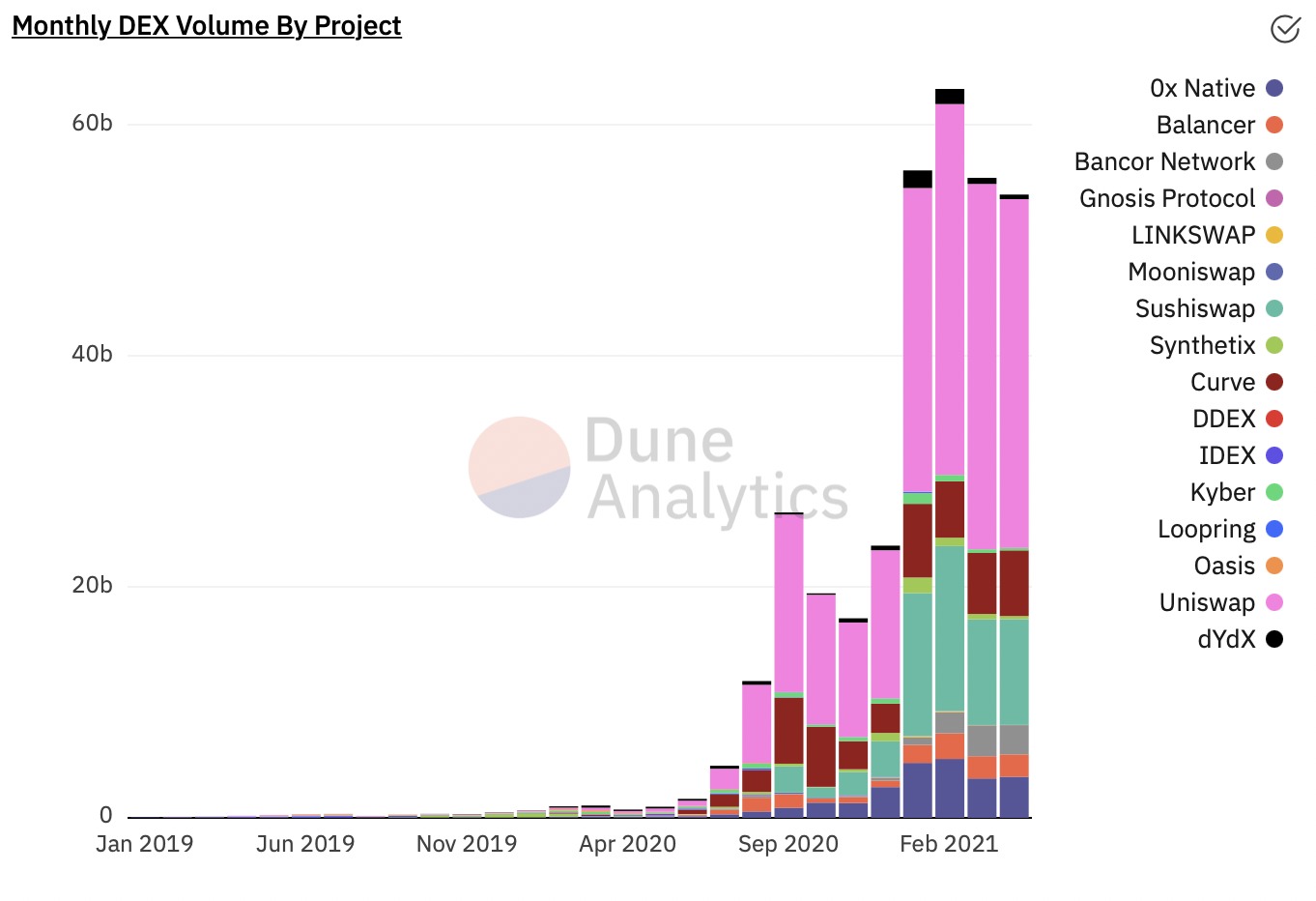

Decentralized Exchanges (DEx) are one of the essential functions of DeFi, with the maximum amount of capital locked compared to other DeFi protocols. DExs allows users to exchange or swap tokens with other assets, without a centralized intermediary, custodian, and KYC. Everything you need is the Metamask wallet. The first DEX also called automated money maker is Uniswap which was established in November 2018 and continuously attracted traders. Currently, the monthly volume is even more than on CEXes with $50 MLD a month with Uniswap leading. There will be the Uniswap V3 launch on the 3rd of May. The similar Dex enabling also Bitcoin swaps is build by the Thorchain project.

Asset Management

Another class of service offered by DeFi is asset management. It intends to make investing faster, less expensive, and more democratized. Aspects of the DeFi ecosystem play very favorably for Asset Management, including: transparency, composability, and trustlessness.

Transparency promises to make information accessible and secure, composable to enjoy hyper-customization of portfolios, and trustless to allow access to historically illiquid assets and manage their investment regardless of location. It is Decentralized Hedge Fund simply explained. The main projects in this subfield are :

- Badger DAO

- Vesper

- RenVM

The last two Defi elements Derivates and Payments are not the major ones but also rising. One of the Derivates projects worth mentioning is the Syntetix. Synthetix is a decentralized platform on Ethereum for the creation of Synths: on-chain synthetic assets that track the value of real-world assets. Many projects have been build where you can trade tokenized stocks like Mirror protocol or Deus.

The future and challenges of DeFi

We’re observing a quantum leap in the new possibilities of the functionalities of money through the innovation of distributed ledger technologies. For the first time in history, a global financial system for a worldwide population is being shaped by that very population. Everyone from any place can take part in the governance of DeFi protocols and get a seat at the table where the world of decentralized finance is actively created.

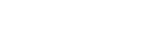

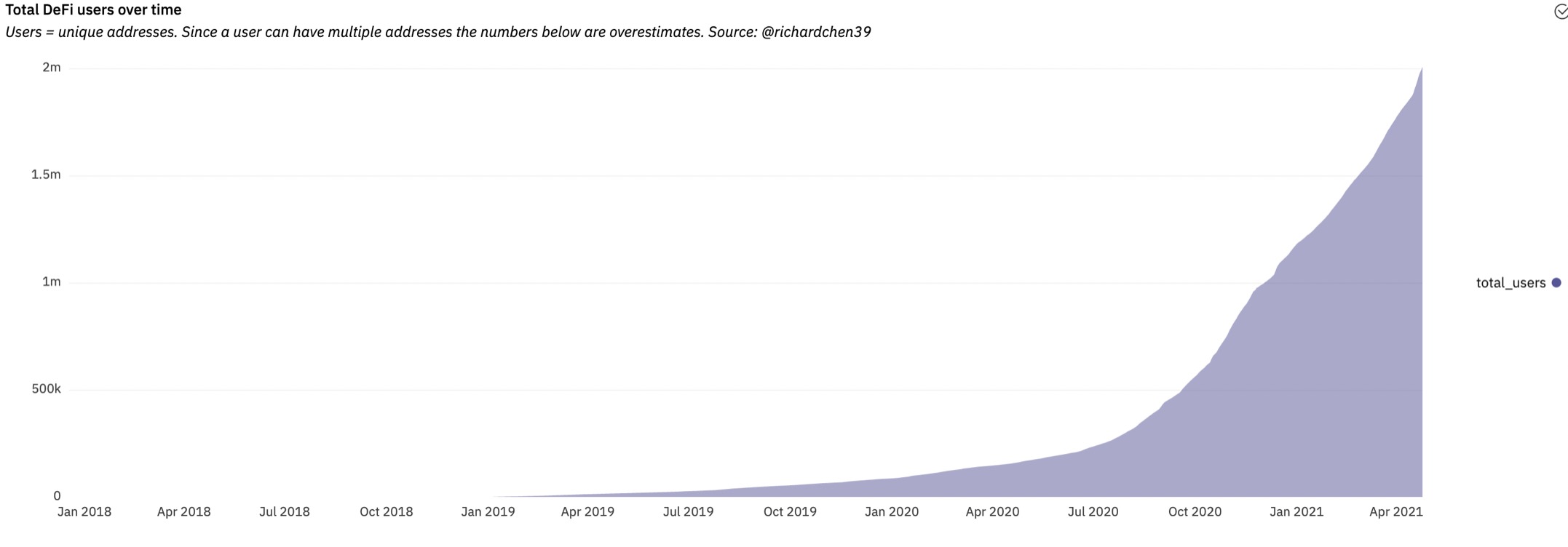

The Defi trends are clearly rising as per data shown below we have currently more than 2 million Defi users and more than $1billion in revenues. We expect these trends continue to rise.

Despite the positive DeFi industry growth there are some challenges that need to be overcome. The biggest challenge for DeFi is the regulatory. Decentralised nature of many projects means there is nobody which is to hold accountable for any misdeeds. Other challenges and limitations include:

- Complexity

- User interface

- Liquidity

- Technical risks – exploits

- On Ramps and Off Ramps – limited interoperability with existed financial system

This is space is still new and every day we are closer to overcome these challenges. The DeFi space is gradually catching up with the traditional financial system and despite some of the obstacles which are certain while operating on the bleeding edge of innovation, the world of decentralized finance is on the path to prosperity.

Over time, it’s difficult to predict how this space will shape when the power to build financial services will democratize. However, at the point where DeFI and fintech map and merge, we’ll have an inflection point where nascent financial technology is just part of a new financial system. One that realizes the dream of being fast, secure, available, and egalitarian.

Eastboy

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.