Quick Summary:

- Since the beginning of 2023, the price of bitcoin has been rising, and a price correction is about to occur.

- The indicators signal a bullish divergence which could be followed by a trend reversal.

Surviving through an extremely bearish year, 2022, Bitcoin welcomed 2023 with encouraging gains. It has been over three weeks since the Bitcoin price is rising but the indicators now suggest, it might face a little retracement here.

Bitcoin Bullish Divergence:

A bullish divergence occurs when the price of an asset is making higher highs, but the relative strength index (RSI) is making lower lows. This can indicate that the underlying asset’s momentum is slowing and that the price may be about to experience a pullback or correction.

Bitcoin price is making higher highs while RSI on a 4-hour timeframe is making lower lows. This suggests that the upwards trend is exhausting and this is the time for a price correction. The Bitcoin Bullish Divergence pattern is already in action. However, it’s important to remember that indicators are just that, indicators, and not necessarily a guarantee of future price movements. Additionally, other factors such as market sentiment, news and events, and global economic conditions may also impact the price of Bitcoin.

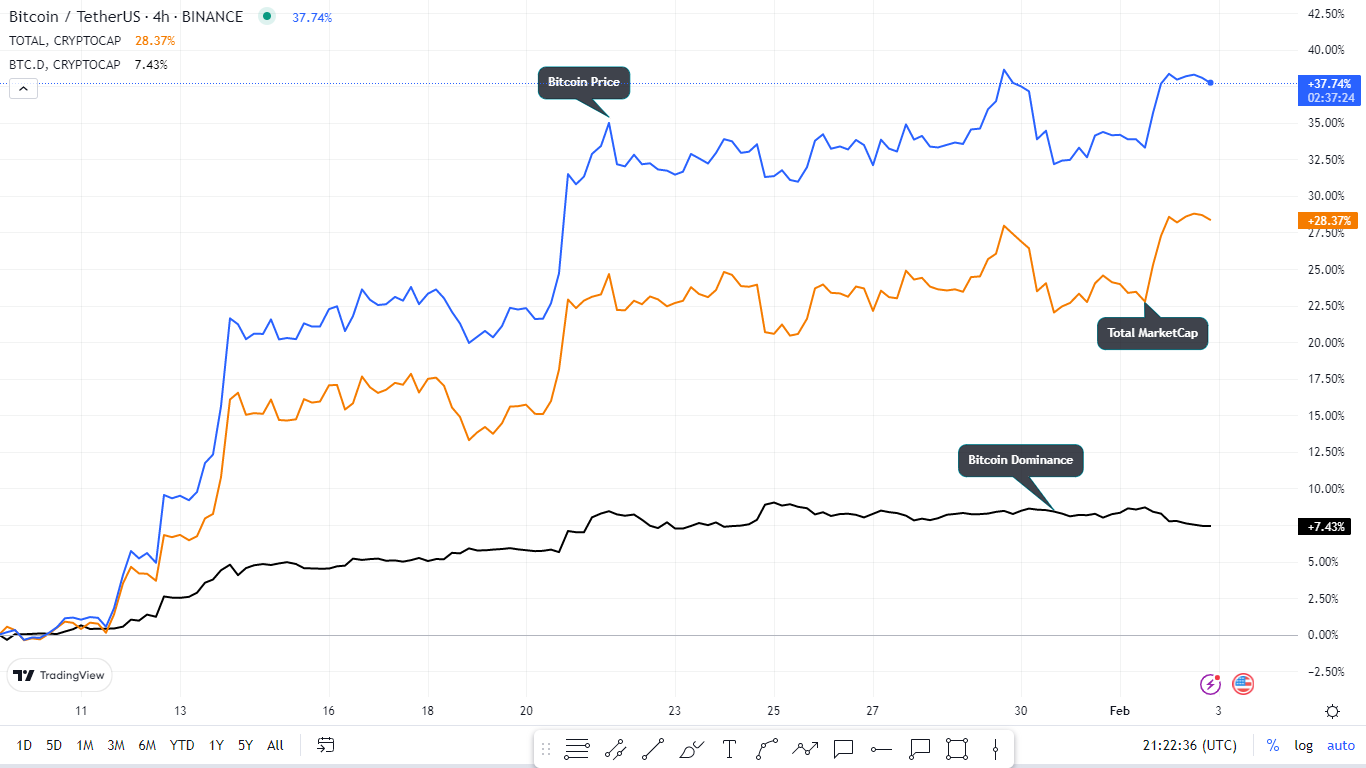

Bitcoin Price and Bitcoin Dominance:

The price of Bitcoin is increasing but its dominance (its share of the total cryptocurrency market capitalization) is decreasing, which suggests that the cryptocurrency market is becoming more diversified and that other digital assets are gaining relative value. The increasing overall market capitalization of cryptocurrencies indicates that there is growing investor interest and demand for digital assets, which is driving up the combined value of the market.

From a technical perspective, this can be seen as a sign of maturity in the cryptocurrency market, as investors become more willing to explore other assets beyond just Bitcoin. This trend can also be influenced by various factors, such as the introduction of new and innovative cryptocurrencies, regulatory developments, and advancements in blockchain technology.

In this scenario, the situation can go in favor of the bears (market participants who are betting on a decrease in price) if investor sentiment shifts away from cryptocurrencies, leading to a decrease in demand and lower prices. This could be triggered by a number of factors, including negative news or regulatory developments, an increase in the supply of digital assets, or a general decrease in risk tolerance among investors.

Another factor that could contribute to bearish market circumstances is a slowing of general economic development, as investors may become more risk-averse and allocate their funds to safer, more established ventures. Furthermore, if the overall market capitalization of cryptocurrencies falls and the value of Bitcoin’s market domination rises, it may imply a return to a more centralised market, which may lead to lower demand for other digital assets.

Conclusion:

Based on the analysis of Bitcoin’s price, market capitalization, and dominance, it appears that there is a potential for a short-term reversal to a local support level. However, it’s crucial to remember that other factors, such as investor attitude, news and events, and global economic conditions, can all have an impact on Bitcoin’s price.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.