Quick Summary

- Technical analysis is a useful tool that professional traders and investors use to analyze the past and possible future direction of a certain market. Technical analysis is useful in all kinds of markets, ranging from stocks to crypto.

Technical analysis is the presumption of the market trend and price movement by incorporating historical data, indicators, and patterns. Traders and investors use special mathematical tools to predict the market movement to seek trade opportunities. Technical traders believe that the market movement is not random but follows patterns. So, if we spot what those patterns are, we can easily predict the market direction.

related: BKEX Review: A Reliable Digital Asset Trading Platform

Candlestick Patterns

Though candlesticks show the price movement yet technical traders believe that their shape can tell a lot to predict the market direction. Traders use one or three candles to identify the trend and trade accordingly.

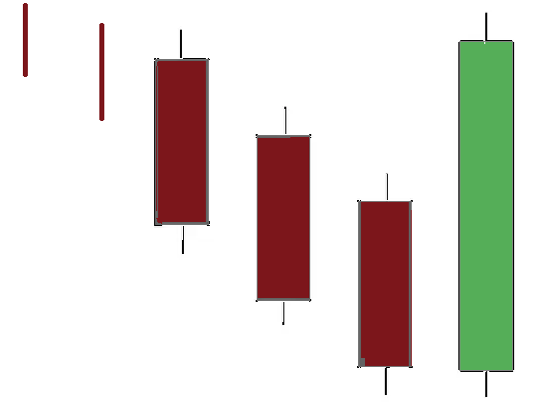

Three Line Strike

This is a trend reversal pattern with an accuracy of 83%. The line Strike can be bullish or bearish depending on the previous trend. As in the image above, the pattern shows a bullish reversal. The price is dropping making lower lows until they strike a huge bullish candle indicating the trend reversal.

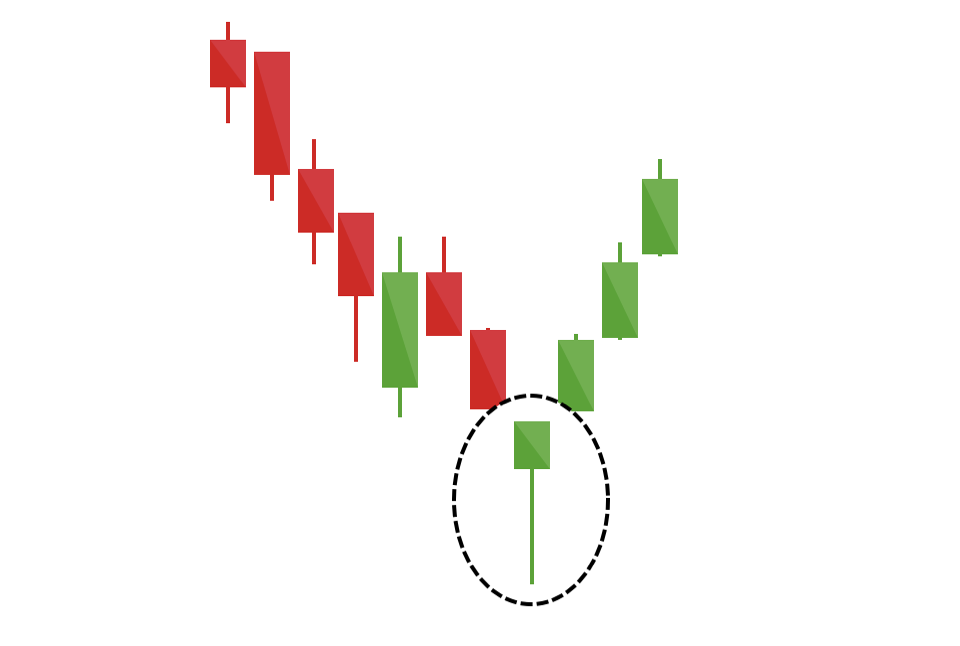

Evening Star and Morning Star

The market moves upwards when new buyers enter the market. Such candles appear at the peak of an uptrend further pulling the price up to a new high. Since new buyers don’t enter the trader this continuation of the bullish run stops. As the selling pressure rises, the existing traders exit the market making it dwindle by making lower lows. Evening Star appears at the bottom and has exactly opposite outcomes. This type of candle has an accuracy of 72% according to Investopedia.

Hammer

These are actually two types of candlesticks: Hammer and inverse Hammer. A hammer is formed while in a downtrend with a short body and a long wick. During a bearish trend, although the price dropped this type of candle shows that there is buying pressure below this price level so a bullish reversal is expected. On contrary to this, the inverse hammer is found in a bullish trend with a strong upper body and lower long wick. This kind of candle shows that though new traders are entering the market there’s a lot more selling pressure above this level so a downtrend is very likely to start.

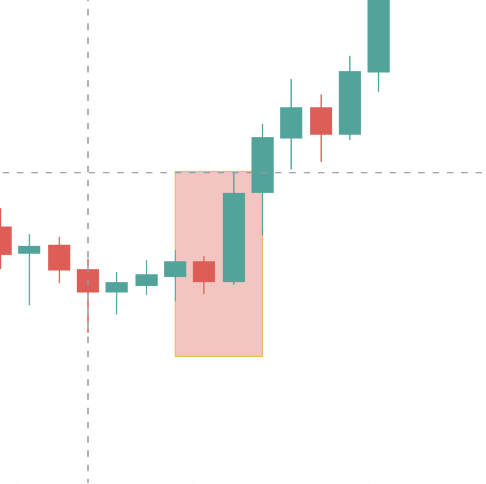

Bullish and Bearish Engulfing

This pattern is defined by two candles during a bearish market trend. There’s one small red candle being engulfed by a large green candle. This clearly sends a bullish signal to buyers to enter the trade and alter the trend. The bearish Engulfing pattern appears in a contrary position and can drag the market downwards causing a reversal.

Conclusion

The reliability of technical analysis is always questioned as no technical or fundamental analysis tool is perfect and this makes the trade even trickier. Market influencers and big players often fake these patterns to knock the retail traders out of the trade. These well-funded players have advanced algorithms with lightning-fast trade abilities.

They alter the market to look so obvious to move in a direction to trap retail investors through fakeouts. It would be wise to first execute the fundamental analysis to spot if there are any influencers in the project and then use these technical factors to spot some reliable trade opportunities.

more to read

WAM As The Most Innovative P2E Crypto Gaming Platform

Big Time – The First AAA Game That Integrates Web3

BAYC’s ApeCoin Highlights Power Problem With NFTs

NFT World News Social Media: Twitter, Instagram, Telegram, Tiktok, Youtube

author: Rene Remsik, mnmansha

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.