Quick Summary

- JP Morgan, the largest US bank, has opened Onyx lounge in Decentraland, making it the first bank in the metaverse. The bank wants to engage in the crypto and metaverse more.

Users can acquire virtual plots of land in the form of NFTs and make purchases with a cryptocurrency backed by the Ethereum (ETH) blockchain in Decentraland or other platforms. However, Decentraland is clearly one of the most popular ones. On Twitter, users have detailed their time at the Onyx lounge, mentioning a portrait of CEO Jamie Dimon and a tiger lurking nearby.

you might wanna read this: Mark Zuckerberg’s Sister Made A Crypto Song

Onyx – Virtual Lounge

JP Morgan, the largest US bank, has opened the Onyx lounge in Decentraland, making it the first lender in the metaverse. The bank’s first excursion into the virtual world is the virtual lounge. JP Morgan’s permissible ETH-based services are known as Oynx. The same name refers to a virtual lounge that allows institutions and corporations to enter the metaverse.

The financial behemoth has released reports on the general acceptance of cryptocurrencies. JP Morgan’s recent paper delves into the metaverse and the possibilities for integrated commerce applications. Customers can now purchase digital treasures and experiences from electronics and fashion companies that have entered the realm of digital real estate and metaverse parties.

“There is a lot of client interest to learn more about the metaverse. We put together our white paper to help clients cut through the noise and highlight what the current reality is, and what needs to be built next in technology, commercial infrastructure, privacy/identity, and workforce, in order to maximize the full potential of our lives in the metaverse”, said Christine Moy, JPMorgan’s head of crypto and metaverse.

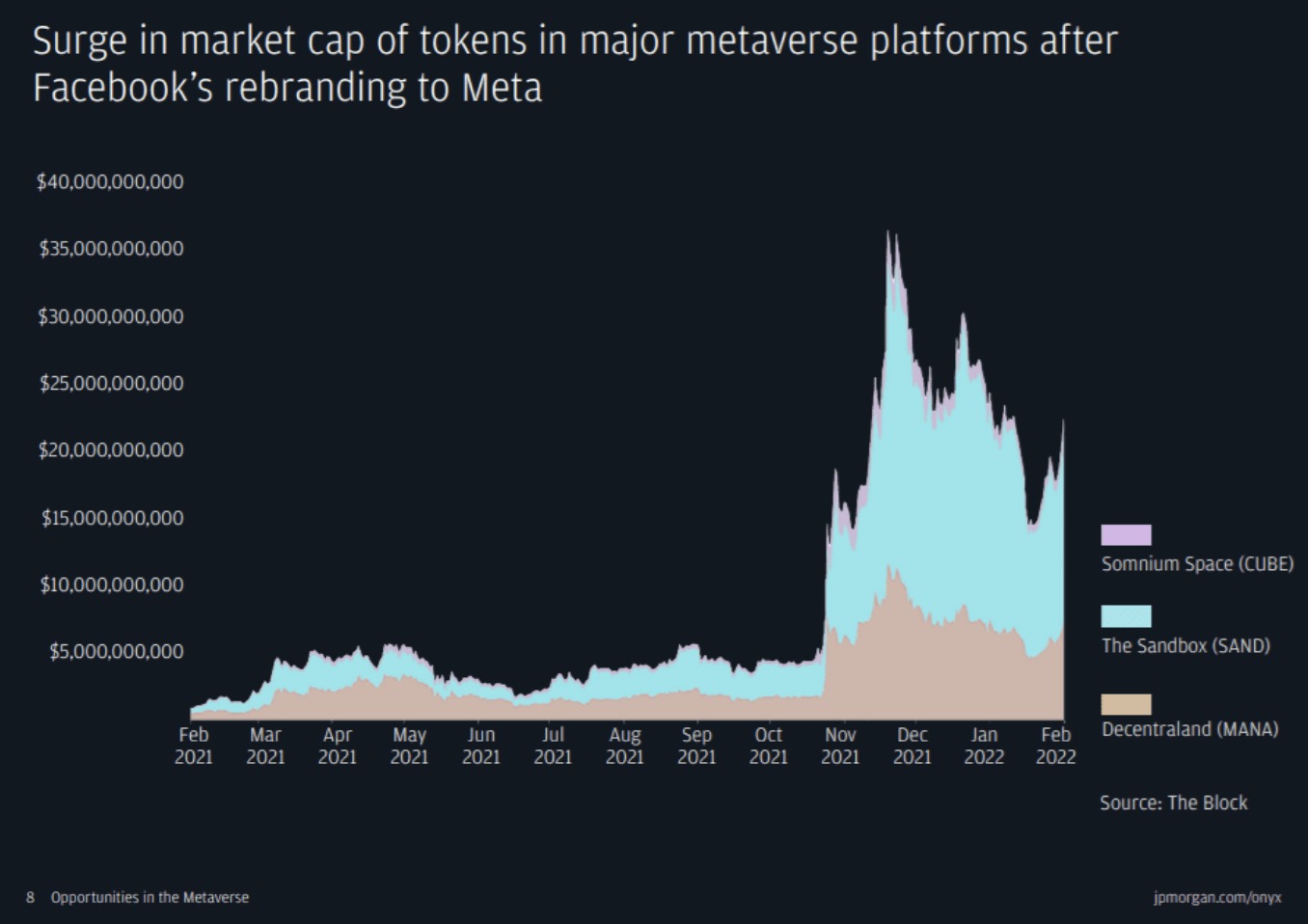

The average price of a virtual plot of land grew in the second half of 2021, climbing from $6,000 in June to $12,000 in December across the four major Web 3 metaverse sites: Decentraland, The Sandbox, Somnium Space, and Cryptovoxels, according to JPMorgan’s examination of “metanomics.”

“In time, the virtual real estate market might see services similar to those offered in the real world,” according to the JPMorgan report. These services include credit, mortgages, and rental agreements. It went on to add that collateral management in decentralized finance (DeFi) might play a role, and that this could be managed by decentralized autonomous organizations (DAOs) rather than traditional finance corporations.

Conclusion

Components of the metaverse continue to evolve at a dizzying speed. Building a corporate strategy around such a dynamic environment marked by rapid development and new entrant innovation might be difficult but it’s necessary. In the upcoming years, you will see the housing markets booming but probably, mainly the virtual ones.

more to read

Snoop Dogg Opened NFT Music Label

Picasso’s Granddaughter Is Making NFTs

The Son Of John Lennon Is Releasing Beatles NFTs

NFT World News Social Media: Twitter, Instagram, Telegram, Tiktok, Youtube

sources: tronweekly, nasdaq, usatoday

author: Rene Remsik

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.