Quick Summary:

- Elon Musk Twitter takeover can benefit the dogecoin bulls as meme coin is the hot favorite of the billionaire.

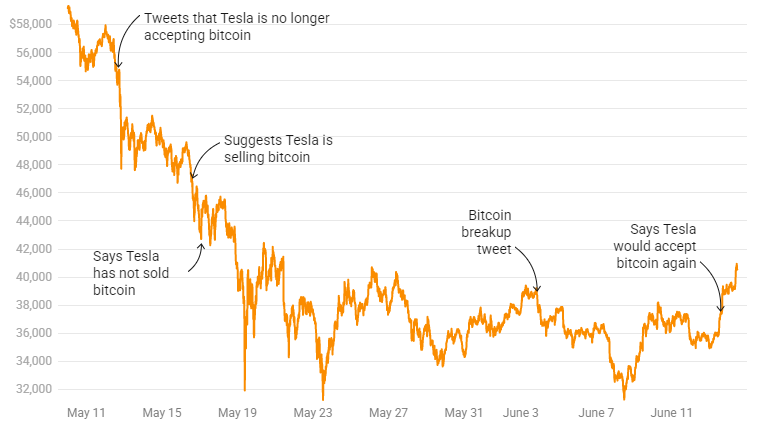

- Musk has been manipulating the crypto prices sending the entire market up and down since January 2021.

Apparently, this eccentric billionaire loves the power and influence he has on the crypto market. The attention he gets from the crypto community is unprecedented. Musk started influencing the market on January 2021 and he was the one who dragged Bitcoin and whole market out of the worst bearish cycle.

Elon Musk Pumping Doge price

Elon Musk ‘dogefied’ in early 2021 and since then the romance between this meme coin and the meme king has been going on. Musk has been the most influential Dogecoin preacher sending the dogecoin price to the skies every now and then.

Particularly there are 5 events when Elon Musk pumped dogecoin leveraging his insane Twitter following.

1. Jan. 28: Dogue magazine cover

Furthermore, Chief Twit tweeted about this joke currency for the first time today. He essentially tweeted a magazine cover with a picture of a dog on it. The only thing he typed was the word “dogue,” which the online community mistook for dogecoin (DOGE).

As a result, dogecoin’s (DOGE) price increased by more than 680 percent in a short period of time, from $0.0078 on January 27 to $0.0610 on January 29.

2. Feb. 4: “Dogecoin is the people’s crypto”

A week later, Elon Musk tweeted once more, this time specifically referring to dogecoin as “People’s crypto” and naming it. As a result, the price of the doge increased by 44% from its prior peak. This tweet was subsequently followed by several tweets of admiration, which only helped to spread this internet meme.

The price of a Doge increased from $0.0314 on February 3 to $0.0451 on February 5.

Dogecoin is the people’s crypto

— Elon Musk (@elonmusk) February 4, 2021

3. Feb. 7: “Who let the Doge out”

He was obviously enjoying the responses to his tweets and how his actions were influencing the doge price. Up until this moment, Elon Musk has dominated media coverage, especially in the dogecoin community.

Opening long positions immediately after the tweets and then shorting again as the “tweet impact” started to die off allowed the dogecoin community to make millions. Dogecoin’s price was constantly fluctuating, and those who played effectively were profiting greatly from it.

🎶 Who let the Doge out 🎶

— Elon Musk (@elonmusk) February 7, 2021

Dogecoin price rose 57%, from $0.0491 on Feb. 6 to $0.0769 on Feb. 8.

4. April 14: “Doge Barking at the Moon” with an image of Miro’s “Dog Barking at the Moon”

When he tweeted about dogecoin for the fourth time, the price of the cryptocurrency humorously increased. This was the first time Dogecoin broke the $0.1 threshold.

The price of dogecoin increased by over 330 percent from $0.0766 on April 13 to $0.1306 on April 15 and $0.3299 on April 16 after Elon Musk tweeted about it on April 14.

5. April 28: “The Dogefather SNL May 8″

The SNL on May 8 of last year was the most notable incident where he was discovered directly pushing the price of Dogecoin.

The Dogefather

— Elon Musk (@elonmusk) April 28, 2021

SNL May 8

This occurrence caused Dogecoin’s price to increase by almost 130 percent, which sent a positive tsunami across the whole cryptocurrency market. Dogecoin’s price increased as a result of the event from $0.2747 on April 27 to $0.6618 in May. The all-time high for dogecoin prices was reached at this point.

Elon Musk Twitter takeover:

Now that he owns Twitter, the dogecoin community expects that he might include dogecoin as a payment method on Twitter, to say the least.

Elon Musk is quite vocal about crypto and his pro-crypto stance will definitely affect the crypto world positively.

With Twitter at his disposal, Musk’s amplified social media reach can act as a double-edged sword in shaping the narrative in the cryptoverse.

Conclusion:

Elon Musk Twitter takeover could be beneficial for the crypto and other blockchain domains as well, however, the impact will take time. Once things are in place at Twitter, the Dogefather is very likely to drop the bullish bombshells.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.