Quick Summary:

With EIP 1559 implementation, the way to Ethereum Merge was defined. Ethereum burns a part of the gas fees to reduce the circulating supply so that the price can strengthen. Ideally, there should be more Ethereum burning than being issued to make Ethereum deflationary. But is it really the case with Ethereum?

Also read: Why we are bullish on Ethereum?

London Hard Fork: The transition to Ethereum Merge

The most prominent Ethereum update EIP 1159 was implemented in August last year. The update was also called London Hard Fork which implemented the Proof of Stake mechanism to increase the scalability. Ethereum 1.0 is a soft cap asset which means the total supply of Ethereum tokens will keep increasing with every transaction. The price of a token is calculated by two factors: MarketCap and Circulating Supply.

Price of a coin=MarketCap/(Circulating Supply)

If the circulating supply of a token keeps rising and the marketcap does not increase at the same rate, the price starts to drop.

Therefore, to control the increasing supply of Ethereum tokens, Ethereum burns a part of the gas fee collected from the traders. These coins are sent to a null address which excludes them from circulation. With this update, Ethereum was predicted to become a deflationary asset.

Is Ethereum being deflationary a scam?

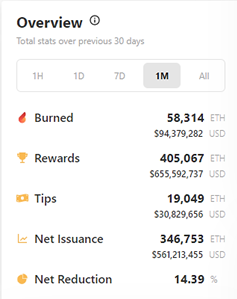

If we look at the last 30 days of Ethereum burn stats, it shows that over 58,000 Ethereum were burned and more than 346,000 Ethereum were issued. This means Ethereum could only reduce 14% of the newly mined coins – Ethereum still is highly inflationary.

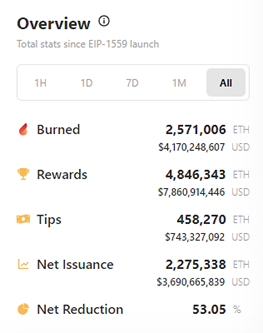

However, if we change the time frame things get interesting. The stats since the implementation of EIP 1159 show that 2.57 million Ethereum are burned so far and 2.27 million Ethereum have been issued.

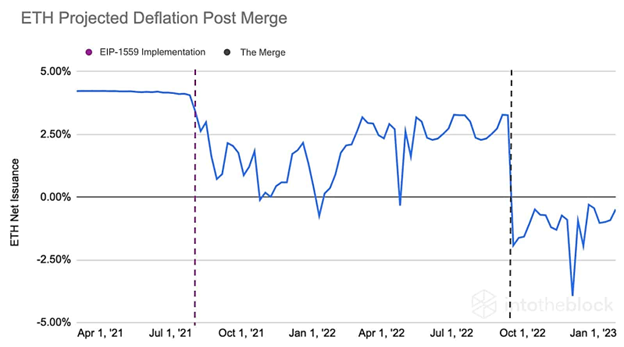

At this time frame, Ethereum is clearly deflationary as more coins are being burned than mined. So how can Ethereum be inflationary and deflationary at the same time?

Ethereum activity impacts and makes it inflationary and deflationary. If there is more activity on Ethereum, the network gets congested and traders have to pay more fees to perform transactions. More fees mean, more Ethereum coins are burned – making it deflationary.

Since now is the bear market and there is not as much traffic as used to be, traders pay fewer fees so fewer coins are burned but the inflation rate remains the same. This makes Ethereum inflationary in a situation like this.

Conclusion:

Ethereum is working on its scalability and if it becomes faster so that no one has to pay additional gas fees, how will its claim of being deflationary be justified? Maybe this is not something that Ethereum should advertise. The upcoming Ethereum merge might address this question.

more to read

JP Morgan Might Take Away the Decentralization of Ethereum

Hacker Attempts to Find Millions Lost in Bitcoin

Follow NFT World News: Twitter, Instagram, Telegram, Tiktok, Youtube, Twitch

author: mnmansha

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.