NFT investors have played a pivotal role in fueling the rise and popularity of the NFT market. The influx of investment has propelled the value of NFTs to astonishing heights, with individual tokens fetching millions of dollars.

Nevertheless, it is important to acknowledge the inherent risks within the NFT market. The value of NFTs can be highly volatile, and there is no guarantee that a specific token will appreciate in value over time. Furthermore, concerns have arisen regarding the impact of speculative investment on the true value of digital art and other forms of creative expression as the market continues to expand.

Despite these risks, many NFT investors remain optimistic about the potential of this emerging asset class. They perceive NFTs as a new frontier in art. Collectibles, and creative expression, and anticipate their value to appreciate as the market matures and gains wider acceptance.

NFT investors are actively shaping the future of the digital art and collectibles market, making their impact significant. Despite the inherent risks associated with NFT investments, the allure of potential financial gains and the chance to support and collect one-of-a-kind digital assets have attracted an increasing number of investors to this thrilling new asset class.

Here are a few noteworthy instances of NFT investors who have achieved remarkable profits:

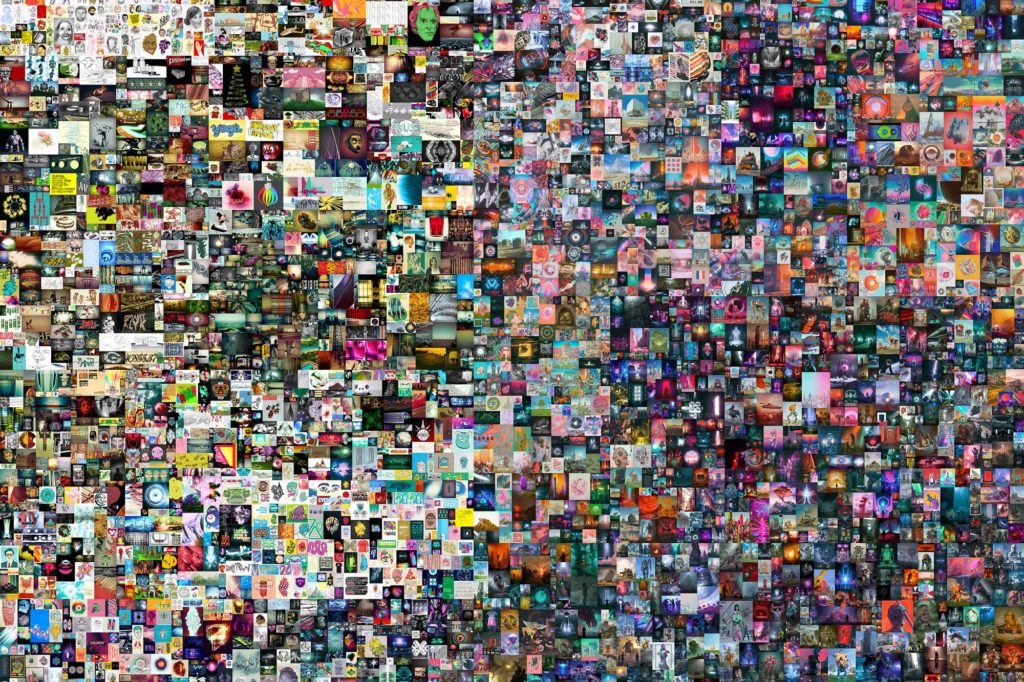

In March 2021, the digital artist known as Beeple gained significant attention when one of his NFT pieces titled “Everydays: The First 5000 Days” sold at a Christie’s auction for a staggering $69 million. This artwork was a compilation of images that Beeple had diligently created on a daily basis for over 13 years. The buyer of Beeple’s remarkable artwork was Vignesh Sundaresan, also known as MetaKovan, who reportedly spent $69 million worth of cryptocurrency to acquire the NFT. This acquisition solidified Sundaresan’s position as one of the most prominent NFT investors to date.

Even Twitter CEO Jack Dorsey hopped on the NFT bandwagon. He sold an NFT representing his first tweet, “just setting up my twttr,” for an impressive $2.9 million in March 2021. All the proceeds from this sale were generously donated to charitable causes.

Billionaire investor Mark Cuban has been an outspoken advocate of NFTs and has actively invested in various NFT startups. He also personally acquired several NFTs, including a digital collectible of NBA player Luka Doncic for $4.3 million in March 2021.

The musician Grimes dived into the NFT market and managed to sell a series of NFTs comprising original music, artwork, and videos for a total of $6 million in February 2021.

Justin Sun, the founder of the cryptocurrency TRON, made headlines when he spent $69 million on an NFT artwork titled “The First 5000 Days” by Beeple in March 2021. This acquisition propelled Sun into the ranks of the most prominent NFT investors in history.

Pak, a renowned digital artist, experienced immense success with his NFT collections. In March 2021, Pak’s collection called “The Fungible” sold for $2.8 million on Nifty Gateway. Additionally, in April 2021, Pak’s “Archetypes” collection achieved an astonishing $9 million in sales on the same platform.

Another Pak piece, The Merge officially became the most expensive NFT ever sold on December 2, 2021, with almost 30,000 collectors pitching together for a total cost of $91.8m.

Justin Blau, also known as 3LAU, a DJ and music producer, capitalized on the NFT craze as well. In February 2021, he sold an NFT album titled “Ultraviolet” for a remarkable $11.6 million on Nifty Gateway. The album consisted of 33 unique NFTs featuring music, artwork, and exclusive content.

Whaleshark, a pseudonymous NFT collector, amassed an impressive portfolio of over 15,000 NFTs valued in the millions. Whaleshark has emerged as a prominent figure within the NFT community, garnering attention through various news articles and interviews. Notably, in March 2021, Whaleshark acquired a rare CryptoPunk NFT for 4,200 ETH (equivalent to approximately $7.6 million at the time), making it one of the most expensive CryptoPunk sales to date.

Here are some key insights extracted from their achievements

- Digital Art as a Valuable Asset: The success of top NFT investors has proven that digital artwork can hold significant value, comparable to physical art. This recognition has elevated the status of digital art as a valuable asset class.

- Scarcity and Value: NFTs possess inherent scarcity as unique and one-of-a-kind assets. This scarcity drives up their value, as collectors recognize the exclusivity and are willing to pay a premium for owning something truly distinctive and irreplicable.

- Influence of Celebrity: Prominent figures like Mark Cuban and Jack Dorsey, who are associated with NFTs, have the power to enhance their value through their celebrity status alone. Their involvement attracts attention and contributes to the growth of the NFT market.

- Early Entry and Timing: Many successful NFT investors entered the market at an early stage, before it experienced a significant surge. This early adoption allowed them to acquire valuable NFTs at relatively low costs and subsequently capitalize on increased demand, selling their assets at a profit.

- Community Support: The NFT community is known for its strong and supportive nature. Investors and collectors actively engage in sharing information and resources, creating a collaborative environment. Being part of this community provides access to valuable insights, helps investors stay informed about trends, and make well-informed investment decisions.

Conclusion

Investing in NFTs comes with inherent risks that should be acknowledged. The NFT market is still in its early stages, and uncertainties exist regarding the long-term value of these assets. As with any investment, it is crucial for investors to conduct thorough research and diligently assess the potential risks and rewards before allocating their funds to NFTs.

The success of top NFT investors underscores the significance of timing, community engagement, and recognizing the value of digital assets. These valuable lessons emphasize the importance of being well-positioned in the market, actively participating in the NFT community, and understanding the potential of digital assets. As the NFT market continues its growth and evolution, we can anticipate further instances of investors and collectors reaping substantial profits from these exceptional and highly sought-after assets.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.