Quick Summary

- BendDAO is an ‘NFTFi’ or NFT Finance platform that lets people borrow money by depositing their NFTs. There have been only a few WETH left in the smart contract that forms the liquidity pool, which means the platform might collapse and hurt everyone who deposited NFTs.

What if BendDAO NFT-Fi?

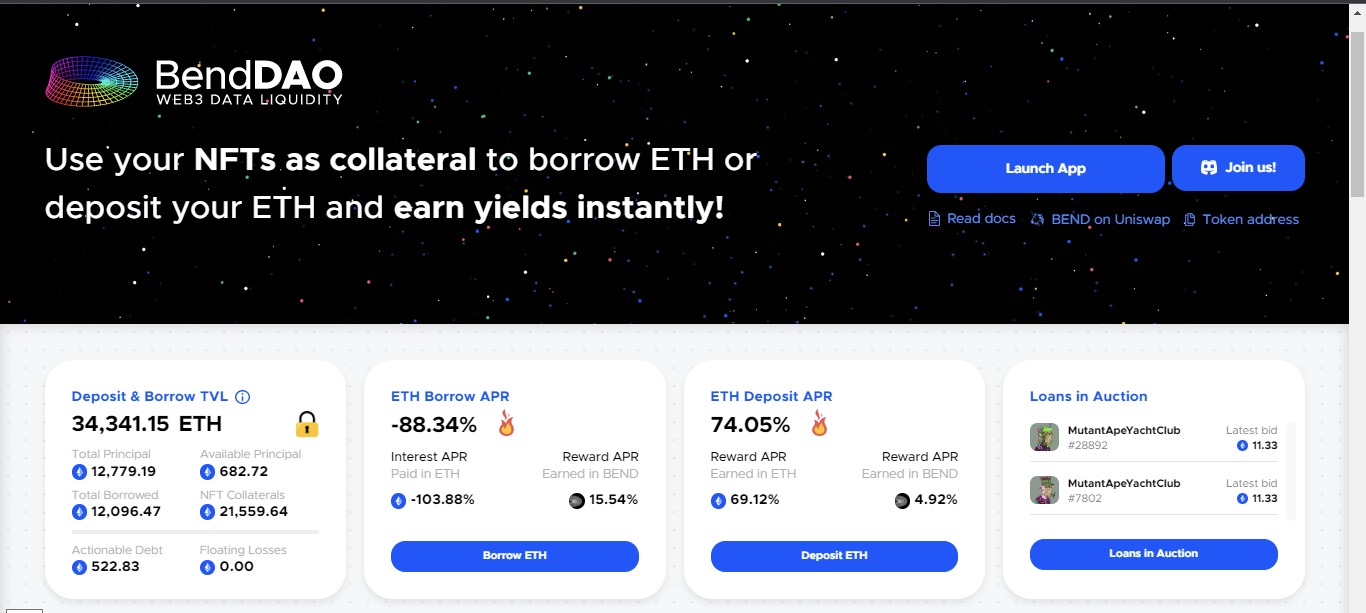

BendDAO is a liquidity protocol that allows NFT holders to claim an NFT-backed loan. NFT holders can claim 40% of the floor price of the collection instantly. Also, those who have Ethereum or BEND coins in their wallet can provide liquidity and earn 8.15% APR. However, if the price of NFT drops 60% and comes near the debt value, the NFT depositor can face liquidation. The platform gives 48 hours in such cases to repay the loan or the NFT will be put for auction. The health (risk) of the NFT deposited can be checked here.

Related: Maple Finance Partnered Up With Celsius To Launch “WETH Lending Pool”

Why BendDAO can collapse the NFT market

Currently, the platform supports only 7 collections, which are the top blue chip NFTs like Bored Ape Yacht Club, Crypto Punks, Mutant Ape Yacht Club, and others. This lending and borrowing protocol has a liquidity of 12,779.19 WETH ($20.44 million). If something goes wrong, it will send a shock wave across the entire NFT market – and it almost happened.

Yesterday, there was only 12.5 WETH left in the liquidity of the protocol. This could lead to many problems, the most prominent one being the inability to pay the lenders. If someone wants to reclaim NFTs, there was not enough funds to repay. Furthermore, since no one could claim their NFTs, if the floor price dropped, their NFTs will be auctioned after 48 hours.

However, with a sigh of relief, BendDAO quickly realized the emptying liquidity and proposed emergency changes to deal with this funds crisis. The Developer team of BendNFT released a statement,

“We are sorry that we underestimated how illiquid NFTs could be in a bear market when setting the initial parameters”

According to the new proposed changes, the liquidation threshold for the collateral is set to 70% instead of 85%. Also, the liquidation period has changed from 48 hours to 4 hours only. Interest rates on loans are to be reset from the current 100% to 20%. The BendDAO will work on bad debt to use revenues to avoid such situations in the future.

BendDAO has pretty much dealt with the situation, for now. The proposed changes will be implemented anytime as the proposal passed with 99.23% in favor.

Conclusion

The current bear market is affecting everyone, particularly the NFT enthusiasts. Though the chaos has been avoided with the swift response from the devs, the protocols like BendDAO should be tested rigorously before the final implementation.

more to read

Droid Capital is a Definition of OG Crypto NFT Project

What is Defi – decentralized finance and the future of banking?

Follow NFT World News: Twitter, Instagram, Telegram, Tiktok, Youtube, Twitch

author: mnmansha

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.