Amidst the hype and potential for massive gains, cautionary tales of costly NFT blunders serve as a stark reminder of the risks involved. NFTs and web3 are enjoying huge traction and people are getting rich with their investments. But this is about three unfortunate guys who lost almost everything because of their little negligence.

Costly NFT Blunders

1. Franklin’s Fake Bid

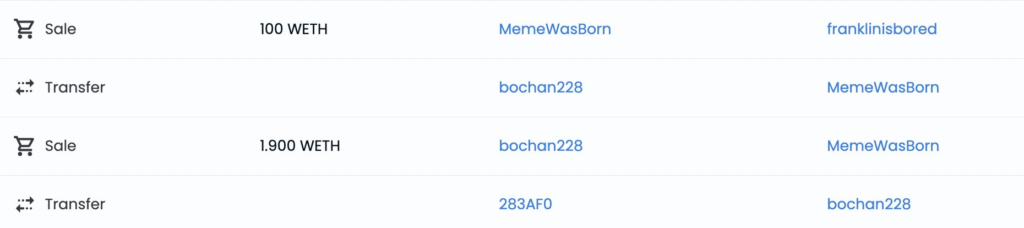

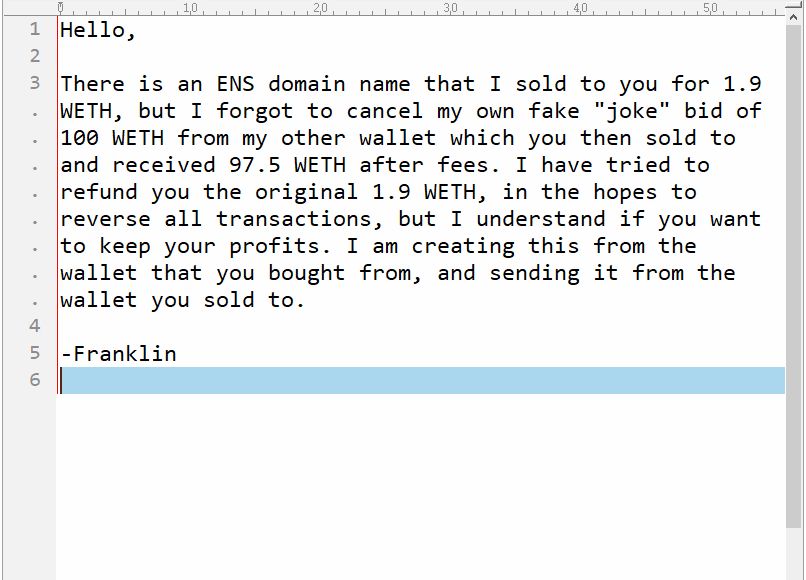

Franklin minted his own NFT that said “stop-doing-fake-bids-its-honestly-lame-my-guy.eth”. Since his NFT was not getting exposure and the bids he expected, he decided to place a fake bid on his own NFT as a joke.

Because of his fake high bid, his NFT got someone’s attention and he offered Franklin 1.9 ETH which Franklin immediately accepted. Franklin rushed to Twitter to celebrate his NFT sale.

Well this is the most surprising 1.891 ETH I have ever made. I owe it all to #ENS and @gweiman_eth’s creative idea. #Marketing101 pic.twitter.com/wk6CFBkugx

— Franklin (@franklinisbored) July 20, 2022

But here is a problem, overwhelmed by the 1.9 ETH he made, he forgot to cancel his own bid. The buyer immediately sold the NFT back to Franklin’s fake bid for 100 ETH.

This small mistake and shrewd move cost Franklin $160k and the person who bought his NFT and sold him back became $160k richer. Franklin’s simple oversight turned out to be one of the costly NFT blunders.

Franklin wrote the buyer about his blunder, revealing the truth behind the 100 ETH bid and asked him to return his 100 ETH. The buyer responded by sending Franklin a meme NFT.

2. Dino’s Million Dollar Rock

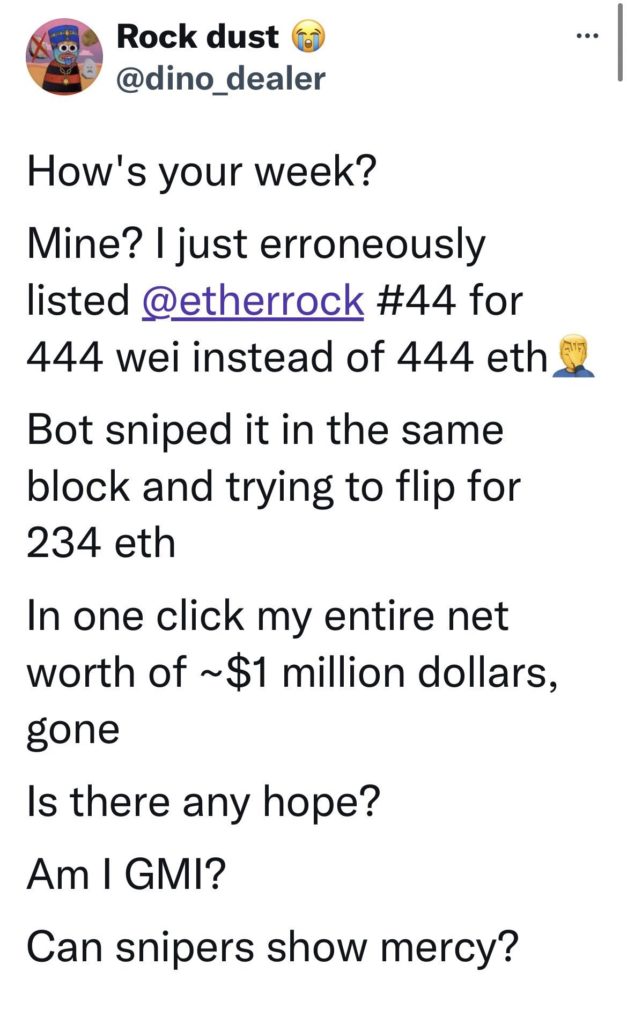

Dino Dealer had one of the rare Ethereum Rock NFTs worth more than a million dollars. It was his entire net worth that he lost with a simple typo. When listing his NFT, instead of listing it for 444 WETH Dino Dealer listed it for 444 WEI. And according to ChatGPT,

1 ETH is equivalent to 1,000,000,000,000,000,000 wei (wei being the smallest unit of ether). Therefore, 444 wei is significantly less than 444 ETH. In fact, 444 wei is merely a fraction of a single wei compared to 444 ETH.

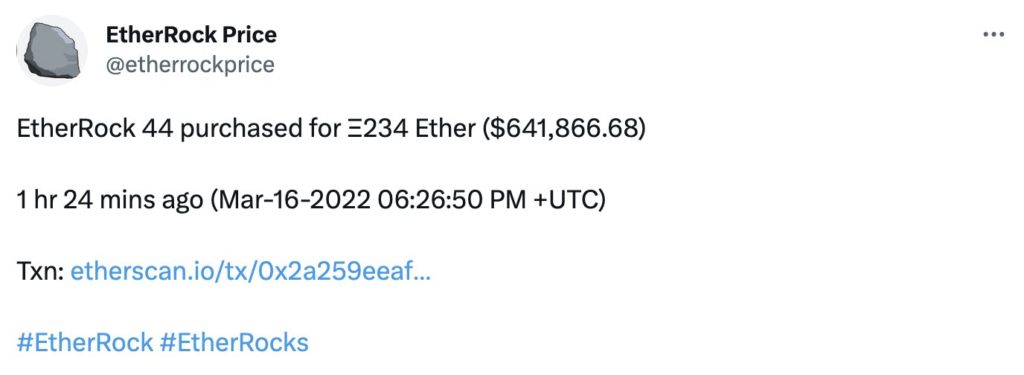

As you read above, the bots were active and the NFT was snipped away in the same block. The buyer instantly placed the bid to resell the NFT for 234 WETH, almost half the price.

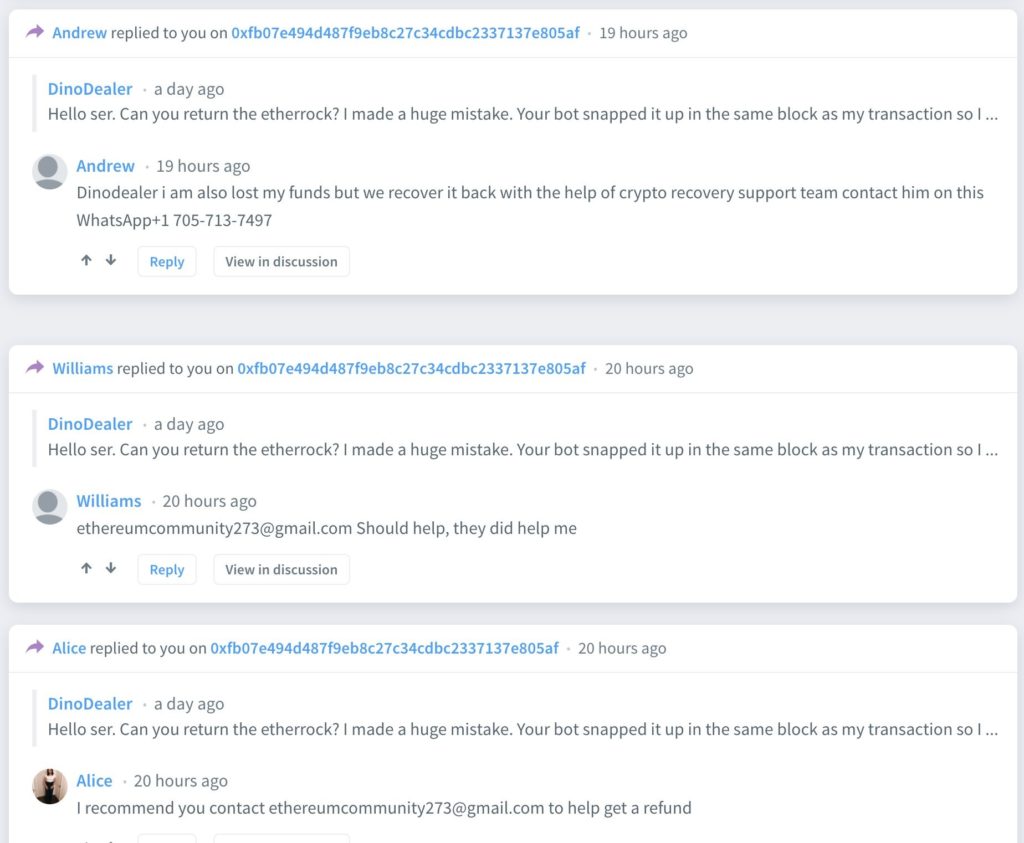

Despite Dino Dealer’s continued mourning, indicated by a crying emoji in his Twitter name, the situation appears to have further complications or consequences. Dino is requesting the buyer to send him back his valuable NFT through blockchain explorer. There are multiple alleged scammers trying to ‘help’ Dino once again.

Days later, the Ethereum Rock 44 was sold for $642k dollars.

3. Keyboard Monkey’s Love for Penguin

Keyboard Monkey sold his penguin NFT for $16k but apparently, that little penguin was his wife’s favorite digital pet and she was not happy about it. So Keyboard Monkey decided to buy it back from the new owner.

Just showed my wife this.

— Keyboard Monkey -KBM- (@KeyboardMonkey3) August 19, 2022

Her: “Why did someone make this?”

“I sold my penguin”

Her: “YOU SOLD THE PENGUIN?! HOW MUCH?”

“$16k”

Her: “WHY THE FUCK WOULD YOU SELL THE PENGUIN FOR $16k?!?!”

..plz lemme buy it back whoever you are mystery person 😭 I FUCKED UP

He placed a bid for $22,000 but someone outbid him. In a desperate move, he placed a higher bid of $32,000. It went smoothly until a bug got him. He forgot to remove his older listing at a lower price so someone again bought the penguin.

Keyboard Monkey somehow contacted the owner and got his penguin back for an undisclosed price. However, even if we don’t take that price into account he still paid $32,000 for the same NFT he sold just for $16,000. But, fortunately, unlike the above two stories, Keyboard Monkey’s story has a happy ending.

Conclusion:

It will be unfair to blame the NFTs or web3 for the costly NFT blunders that these 3 persons made. Web3 is a rather hostile and unforgiving world and we must always watch our steps engaging in transactions, especially when significant fortunes are at stake.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.