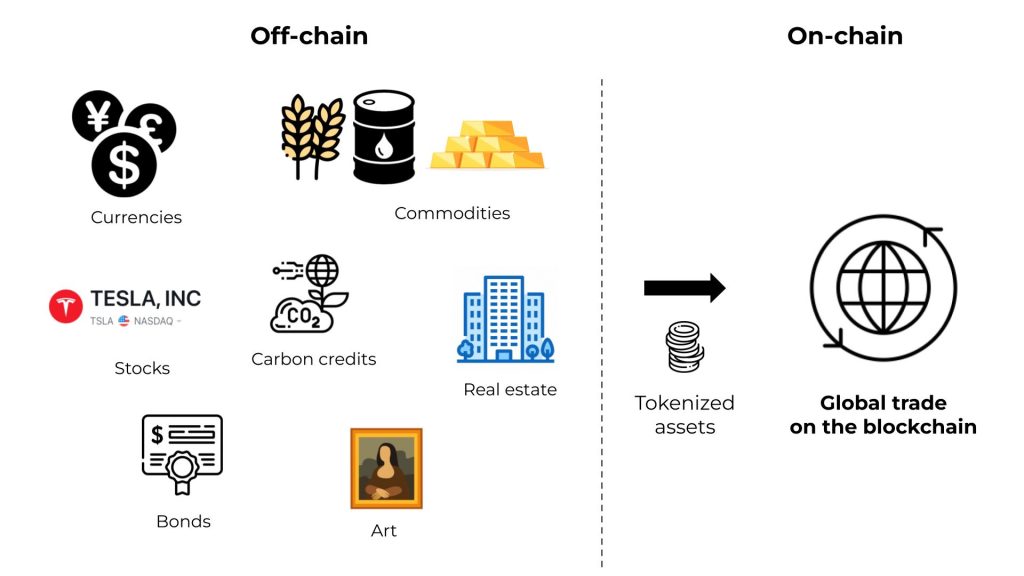

In the ever-evolving landscape of finance, Real World Assets (RWA) have emerged as a pivotal player. These tangible assets, which encompass real estate, art, and commodities, are undergoing a transformation, thanks to the advent of blockchain technology. By tokenizing these assets, we are witnessing the bridging of traditional finance and the burgeoning decentralized finance (DeFi) sector.

Why the Push for Tokenization?

The concept of tokenizing RWA is simple: converting these physical assets into digital tokens on a blockchain. This transformation is not just a technological feat but offers a plethora of benefits. It promises increased liquidity, enhanced transparency, and greater accessibility. Moreover, it democratizes access to investment opportunities and streamlines transactions, making them more efficient.

Here are some examples of Real World Assets:

– Art: You can own a fraction of a painting by Picasso, Monet, or Van Gogh.

– Diamonds: You can own a share of a rare and beautiful gemstone.

– Real estate: You can own a part of a building, land, or property.

– Gold: You can own a piece of the shiny metal that is used as money and jewellery.

– Stocks: You can own a stake in a company that makes products or services.

The scope of RWA is vast, covering everything from emerging markets and trade finance to sectors like insurance and agriculture. The beauty of tokenization lies in its ability to unlock trapped value. Assets that were once illiquid or challenging to trade can now be easily exchanged on decentralized platforms, opening up a world of possibilities.

Redefining DeFi with RWA

The integration of RWA into DeFi is nothing short of revolutionary. It promises to enhance transparency, reduce transaction costs, and pave the way for the emergence of new markets. By creating a bridge between the physical and digital financial realms, RWA offers tangible yields backed by real revenue. This not only strengthens the value proposition of DeFi protocols but also promises a more stable and reliable financial ecosystem.

The Digital Transformation of Finance

The impact of software on industries has been profound since the 1990s. Today, with the rise of blockchain, traditional finance stands at the cusp of a significant transformation. RWA tokenization is leading this change, promising a more inclusive and global financial future where barriers are minimal, and opportunities are vast.

However, the journey of RWA tokenization is not devoid of challenges. Regulatory hurdles, concerns over asset-backed security, and trust issues are some of the significant roadblocks. Yet, the silver lining is the vast array of opportunities it presents, from democratizing investments to reshaping the very fabric of global finance.

Who can benefit from Real World Assets?

- For asset owners: Tokenization can help them reach more buyers and investors online, increase the value and demand for their assets, and lower their risks and costs of selling or sharing their assets.

- For asset investors: Tokenization can help them access more assets and markets online, diversify their portfolio and reduce their exposure to volatility, and lower their fees and taxes of buying or investing in assets.

- For asset users: Tokenization can help them access more services, products, and experiences online, customize their preferences and choices, and lower their costs of using or enjoying assets.

Peering into the Future

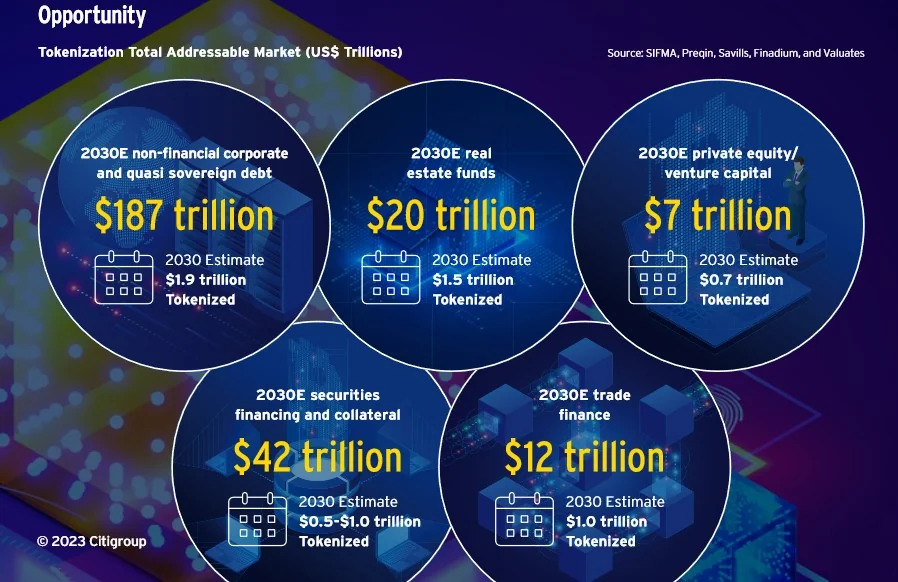

The potential market for RWA is staggering. By 2031, RWA could represent a $32 trillion opportunity. Real estate alone was valued at $3.7 trillion in 2021, highlighting the immense potential of this sector.

The fusion of Real World Assets with blockchain technology is not just a passing trend; it’s a seismic shift in the financial paradigm. As the lines between the physical and digital realms blur, the future of finance is set to be more inclusive, transparent, and efficient than ever before.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.